non filing of income tax return notice under which section

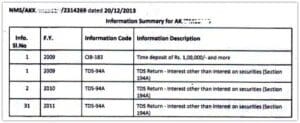

However no TDS return is ordered to be filed if TDS is not obligated to be deducted during that quarter of the financial year. Section 148 If the assessing officer feels some income has been missed a notice is sent under this section as the income will need to be reassessed.

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko

File your revised return and generate XML.

. As per Income Tax Act under section 2003 1961 every individual shall file a quarterly TDS return if the person is responsible for deduction of tax. Based on aggregated sales data for all tax. FBR issues tax notices for imposition of penalty under section 182 2 for Default of Section 114 of The Income Tax Ordinance2001 for filing of tax returns within the given time period.

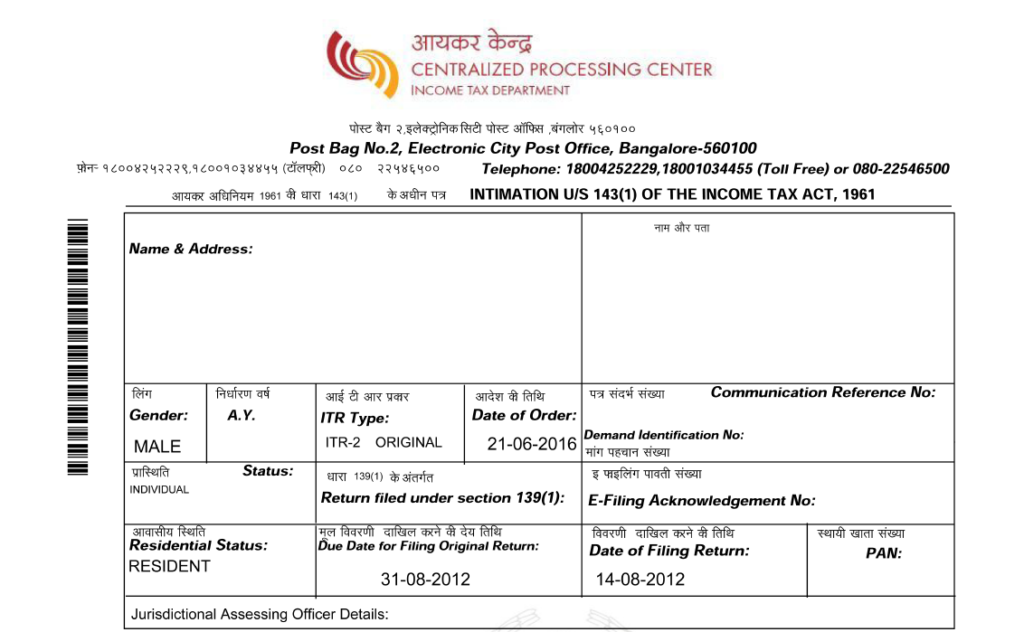

Avoid Notice from Department for Non-filing of TDS Return. Notice under section 142 1 After filing Income tax return if the assessing officer require additional information then income tax notice under section 142 1 is issued in case of non-filing of return a notice under section 142 1 is issued mentioning to file the return before the date as mentioned in the notice. When a notice under section 148 is received the assessee is asked to file a return of the relevant.

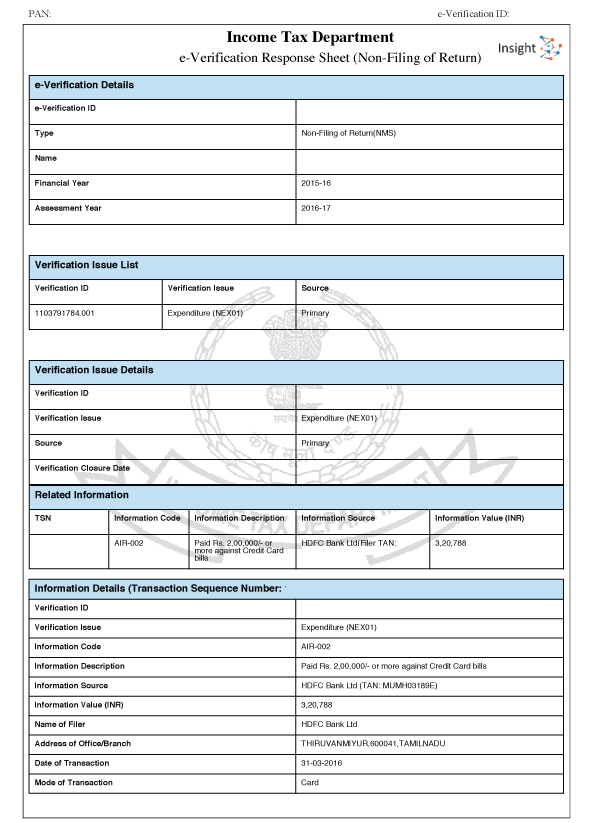

For filing defective return If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. 1 best-selling tax software. This article will guide you to respond to income tax notice issued for non-compliance in filing income tax returns.

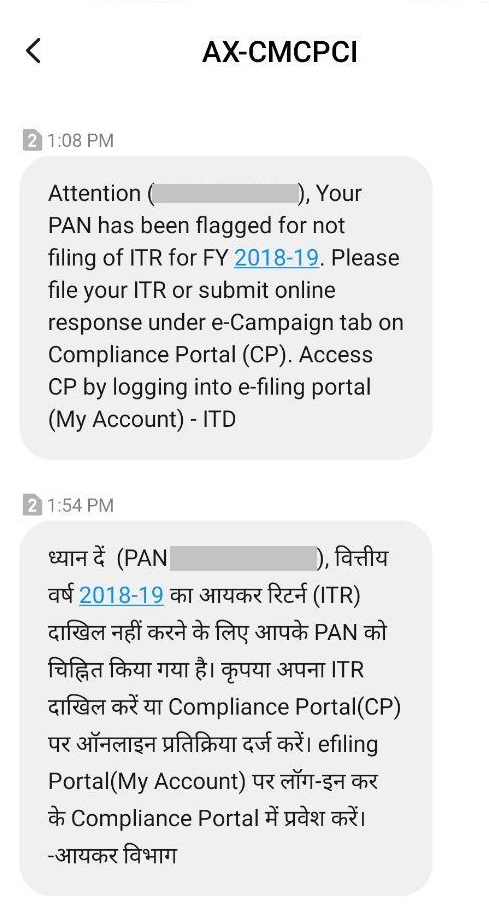

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Taxpayer who has received a notice for non-filing of the Income tax return through an SMS should take the following actions. Notice under this section is received after a detailed enquiry has been done by the assessing officer.

Aged above 80 years with a total annual income of more than Rs5 lakhs. Tax Notices from FBR under section 114 4 and 182 2 Federal Board of Revenue FBR issues tax notices on non-submission of tax return for particular tax year. Go to the For.

Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such. Preliminary Enquiry before an assessment. Follow up to the notice us 1421.

After 11302022 TurboTax Live Full Service customers will be able to amend their 2021 tax return themselves using the Easy Online Amend process described above. The IRS contacting you can be stressful. Ad We Prepare File Personal and Business Tax Returns IRS and CTEC Licensed Tax Preparers.

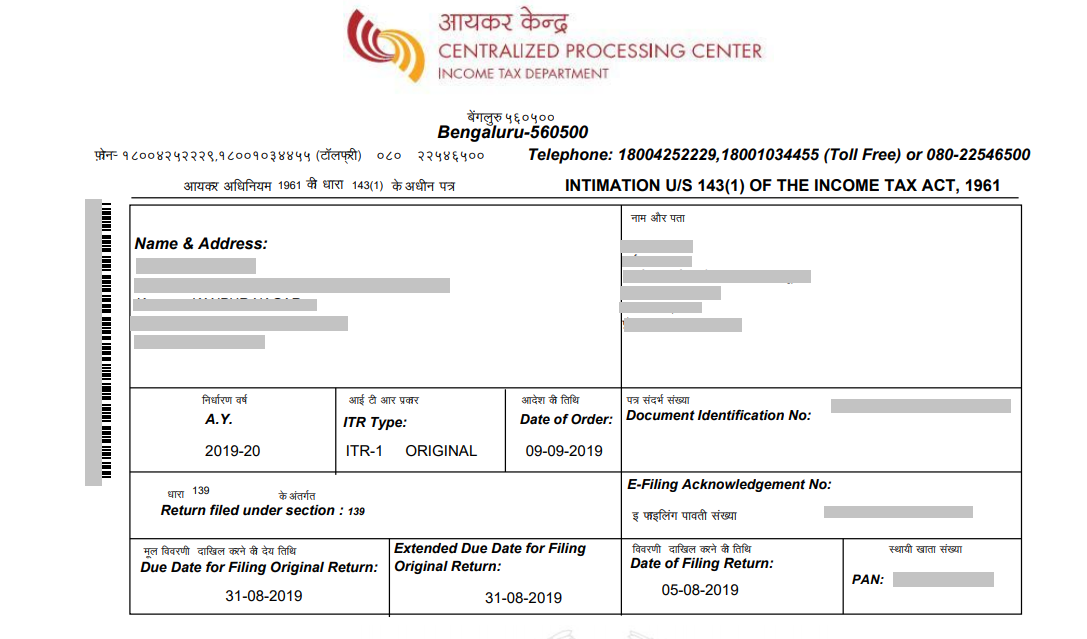

Refund adjusted against the tax demand. If you have a genuine explanation for not filing and if the officer is satisfied with. We work with you and the IRS to settle issues.

Section 156 This notice is about some dues which the tax payer owes to the department. The said penalty for not filing ITR under Section 234F is only applicable to senior citizens meeting the following criteria. Once received you need to respond to it within 15 days from the date of receiving the notice.

Notice for Non-Payment of Self Assessment Tax. The income tax department may issue a notice under Section 271F for not filing ITR. 100s of Top Rated Local Professionals Waiting to Help You Today.

Defective Income Tax Return. You may have to pay a penalty of up to Rs. If you have been filing income tax returns and irrespective of genuine reasons fail to file the income tax department can issue notice to you us 143 2 of Income Tax Act stating non-compliance as the reason of notice.

A BBB Rated For 15 years Complete Online Questionnaire and Submit Documents. The proviso to Section 276-CC gives some relief to genuine assessees. Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the assessee under Section 142 or Section 148 of the Act.

You get a defective return notice under section 1399 of the Income Tax Act. Ad Work with Jackson Hewitt to Find Solutions for Resolving Your Notice From the IRS. Income is concealed or likely to be concealed.

5000 for missing the deadline. If the notice under section 142 1 is not complied with. Aged between 60-80 years with a total annual income of more than Rs3 lakhs.

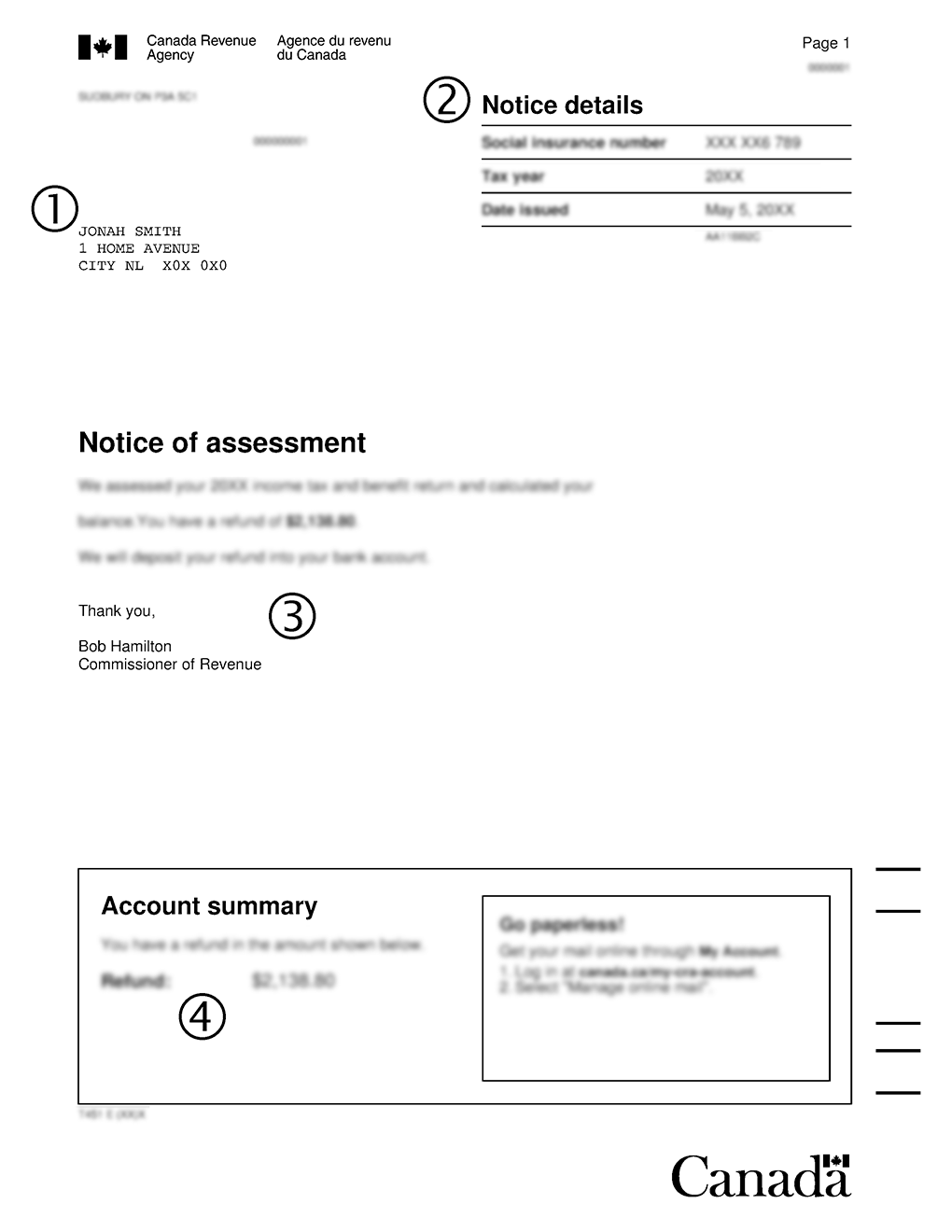

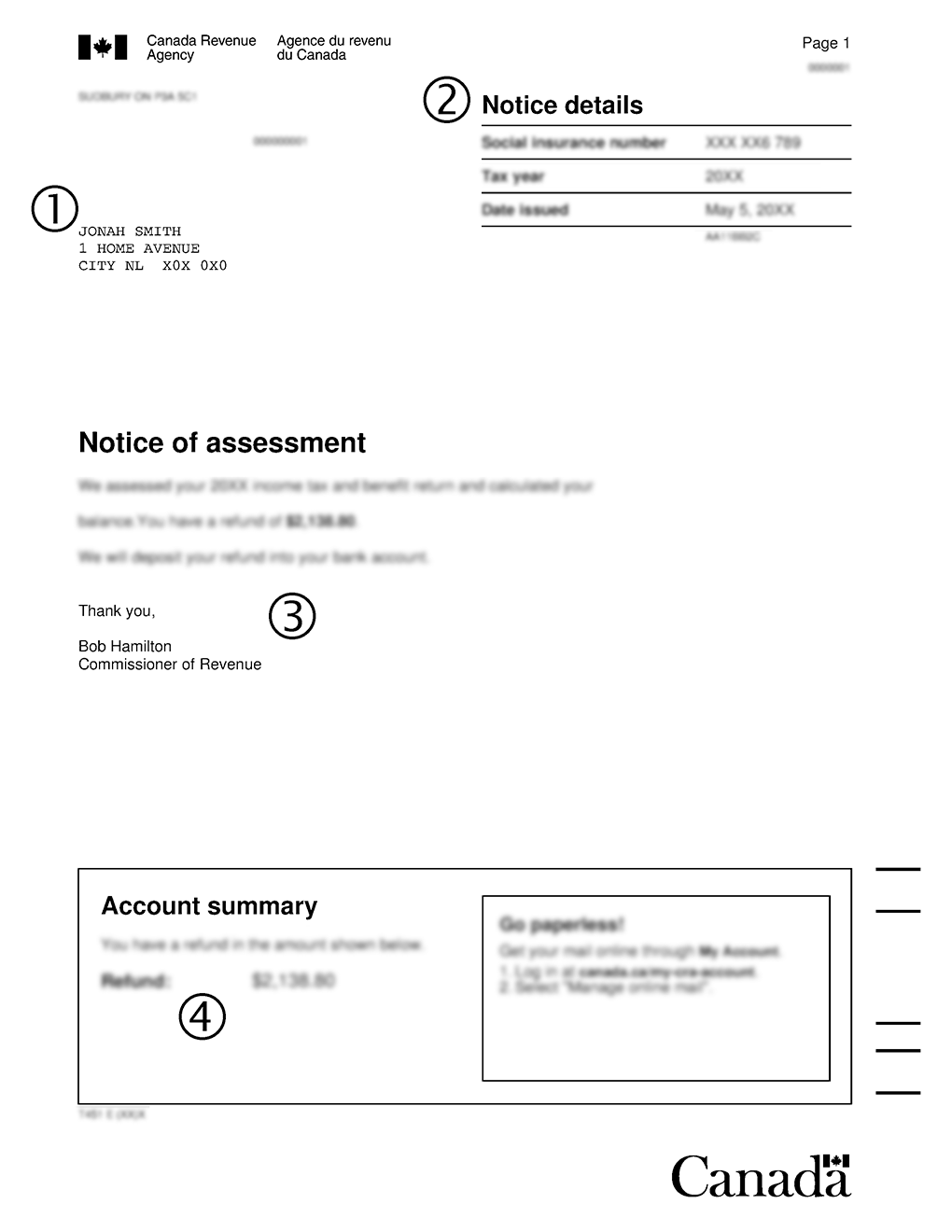

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

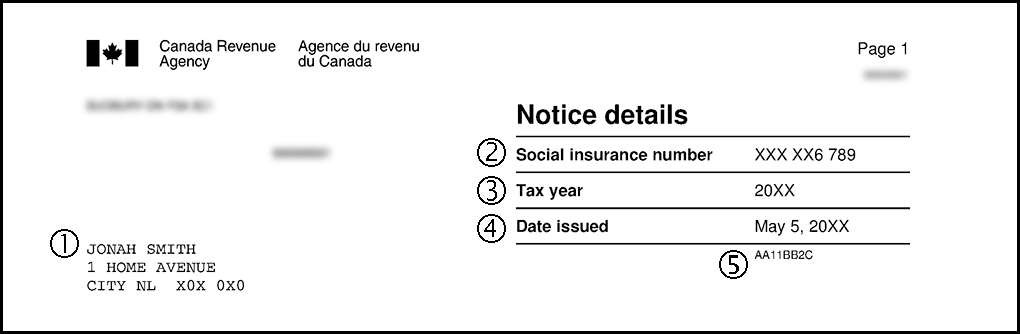

Errors In Reporting Income And Normal Reassessment Period

How To Respond To Non Filing Of Income Tax Return Notice

Notice Of Assessment Expert Fiscaliste

How To Handle Income Tax It Department Notices Eztax

What Is A Notice Of Assessment Noa And T1 General Filing Taxes

Understand Income Tax Notices Learn By Quickolearn By Quicko

Notice Of Assessment Number Quebec Parental Insurance Plan

All You Need To Know About Income Tax Notice Paisabazaar Com

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

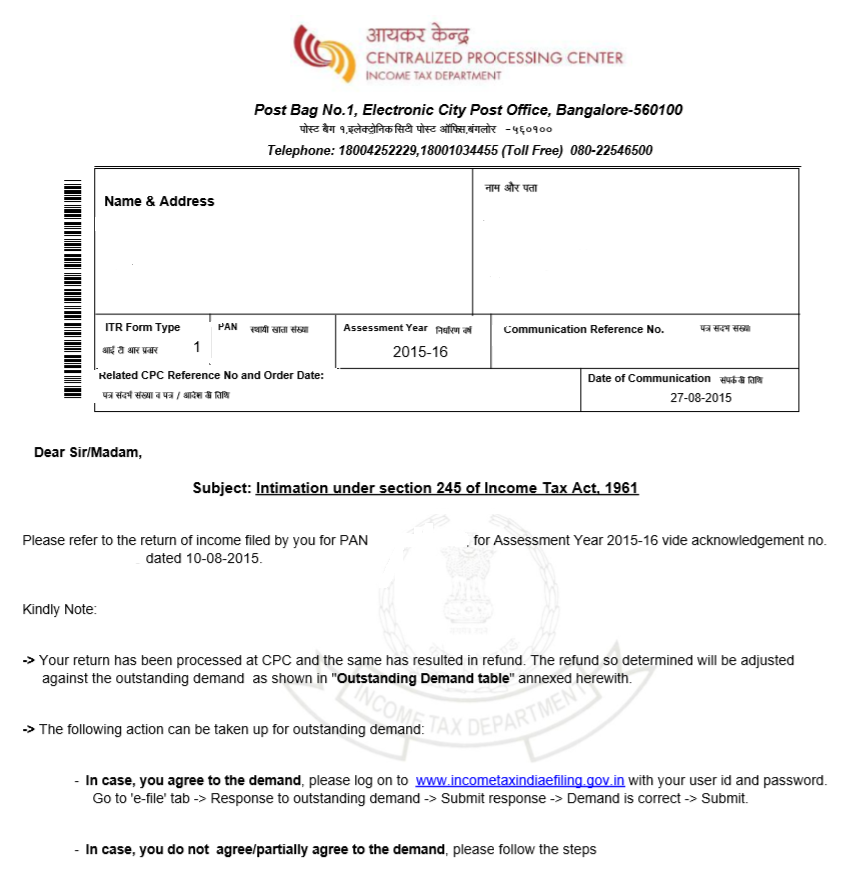

Intimation U S 245 Of Income Tax Act Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

All You Need To Know About Income Tax Notice Paisabazaar Com