maine property tax rates by town 2021

Alĭ ṣonak is a state in the Western United States grouped in the Southwestern and occasionally Mountain subregions. Miami-Dade Countys transfer tax rate depends on the property type.

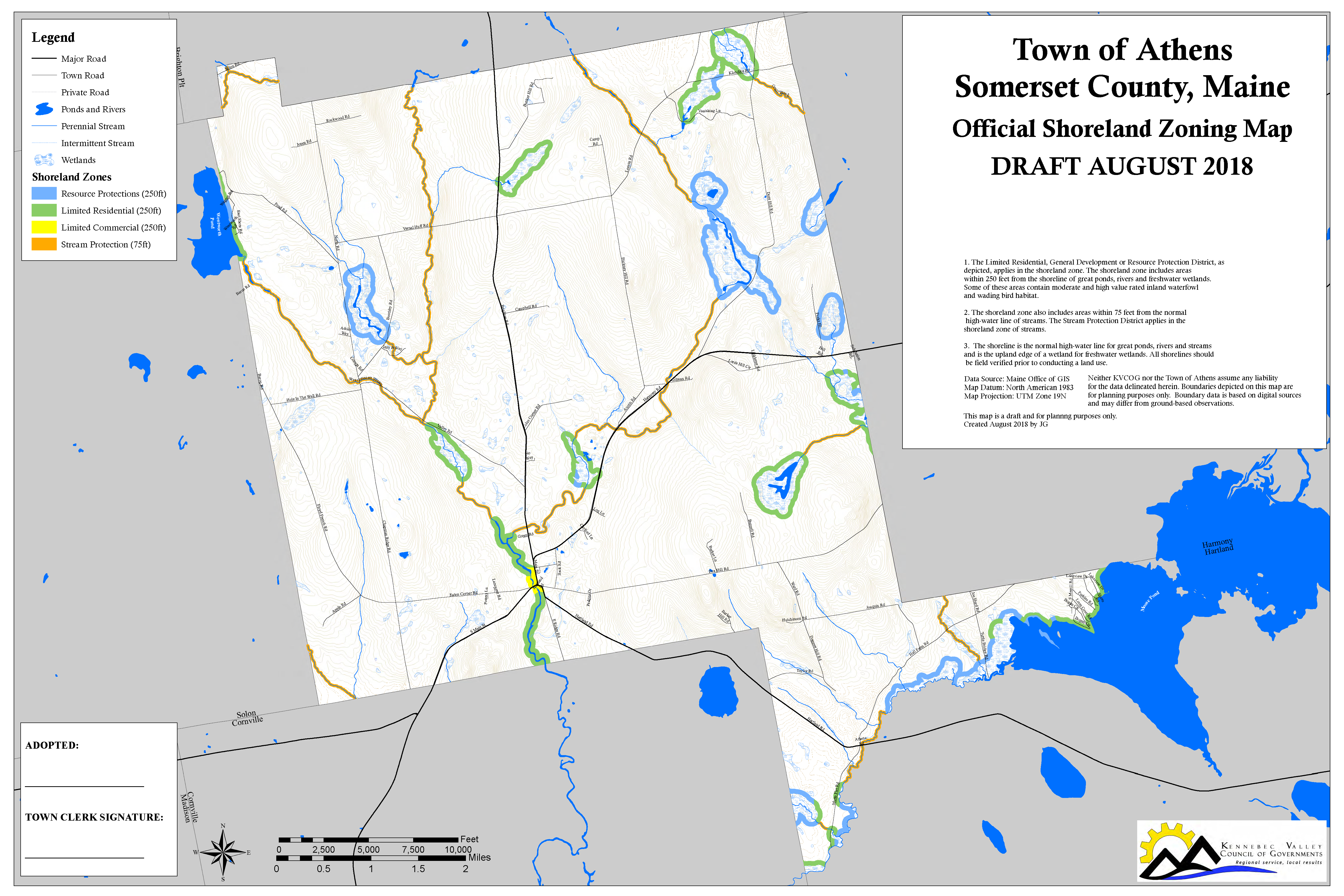

Resources Town Of Athens Maine Selectmen S Minutes Tax Maps

Building Permits Issued.

. Deadline to file an abatement application is March 18 2022. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Because mill rates can differ so much between counties and towns its easiest to compare property taxes using effective property tax rates and not mill rates.

For example if your assessed value is 200000 and your tax rate is 10 your total annual tax would be 2000. By the end of. Tax amount varies by county.

Maine has a personal property tax refund program that is state funded called the. A statement that the corporation is applying or applied section 3011 2 or 3 of Rev. City and school district level.

Tax Acquired Property Bids. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. T own of Conklin.

This is no different from most other New England states like New Hampshire Vermont Maine Connecticut and Rhode Island. From 1929 but the individual tax didnt take effect until 1930 and was restricted to use for property tax relief and the intangibles tax was held. The state sales tax rate is 625 percent.

Tax Commitment Date is September 14 2021. Monday - Friday 800 am. Veterans with our without service-connect disabilities and their surviving spouses in Maine may receive a property tax exemption of up to 6000 on their primary residence if the veteran is 62 years or older or is 100 percent disabled.

The results of the revaluation will be applied to November 2022 property tax bills. New England is a region comprising six states in the Northeastern United States. Its capital and largest city is Phoenix.

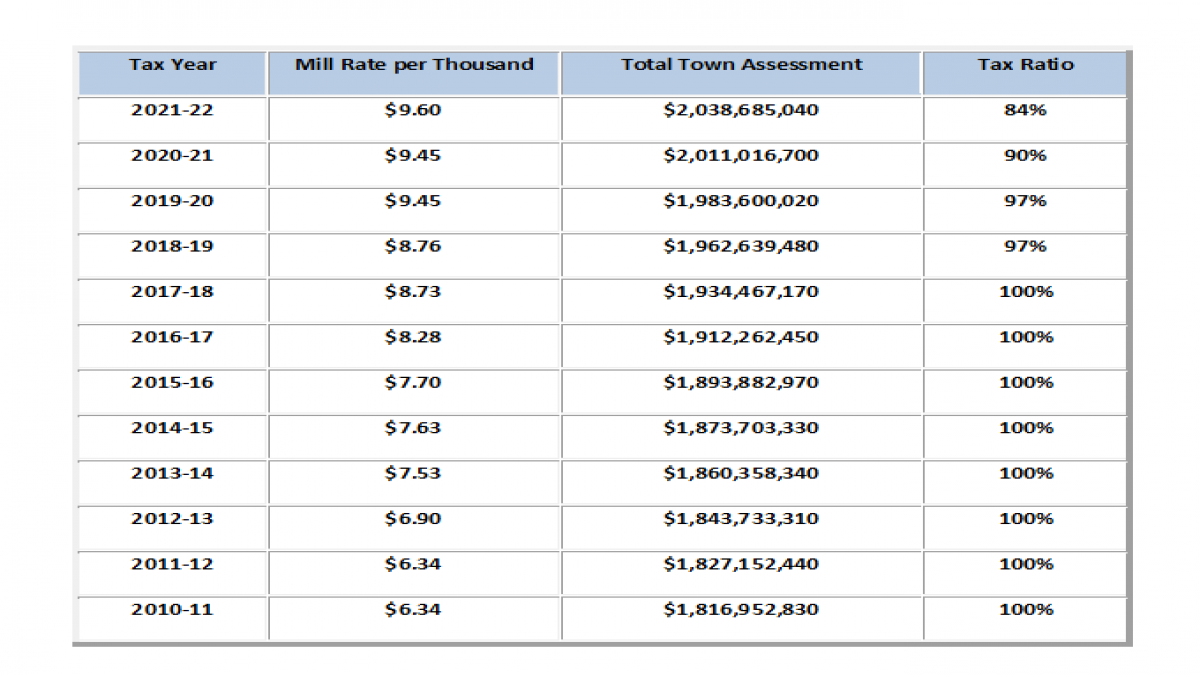

Please contact your town assessor. More exemptions exist for veterans that are paraplegic and for spouses with certain circumstances. They are expressed in dollars per 1000 of assessed value often referred to as mill rates.

Click on the municipality to view the 2021 final assessment roll. JLL names Larry Quinlan to its Board of Directors. The 2021-2022 fiscal year is July 1 2021 to June 30 2022.

Americas Corporate Communications 1 312 228 2112. 207 967-8470 Town Office Hours. 650 0.

Town of Kennebunkport PO Box 566 6 Elm Street. November 19 2021 and May 20 2022. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free.

Connecticuts median income is 85993 per year so the median yearly. Tax Assessor 207 967-1603. With the Governors decision to battle the Corona virus the Board of Selectmen have decided to extend the closure of the the Town Office.

Annual Town Reports Audits. Connecticut has one of the highest average property tax rates in the country with only one states levying higher property taxes. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

Tax Maps - 2021. JLL publishes 2021 Global Sustainability Report. In particular to review their current tax bill andor property record card for accuracy.

The Atlantic Ocean is to the east and southeast and Long Island Sound is. Select LDs with amendments adopted by the HouseYes No Dont Care Select LDs with amendments adopted by the SenateYes No Dont Care Select only LDs with amendments. Oklahoma has a lower state sales tax than 885.

The town of San Antonio was captured twice and Texans were defeated in battle in the Dawson massacre. Code Enforcement Planning Zoning Regulations Summary. Tax Bill Due Dates are November 15 2021 May 15 2022.

Interest Rate for unpaid taxes is 600. Markets PR 1 312 228 3950. The amount of tax-exempt income from forgiveness of the PPP loan that the corporation is treating as received or accrued and for which tax year 2020 or 2021.

If the property is within Miami-Dade county the transfer tax is 06 of the sale price. The 1828 presidential election was the first in which non-property-holding white males could vote in the vast majority of states. Investor PR Capital Markets Hotels Property Management Valuation Advisory Agency Leasing 1 617 848 1572.

Connecticut Maine Massachusetts New Hampshire Rhode Island and VermontIt is bordered by the state of New York to the west and by the Canadian provinces of New Brunswick to the northeast and Quebec to the north. It is the 6th largest and the 14th most populous of the 50 states. Hoozdo Hahoodzo Navajo pronunciation.

We will return your call once the research is complete and we have the information available for you. In Florida there are two distinct transfer tax rates. July 1 to June 30.

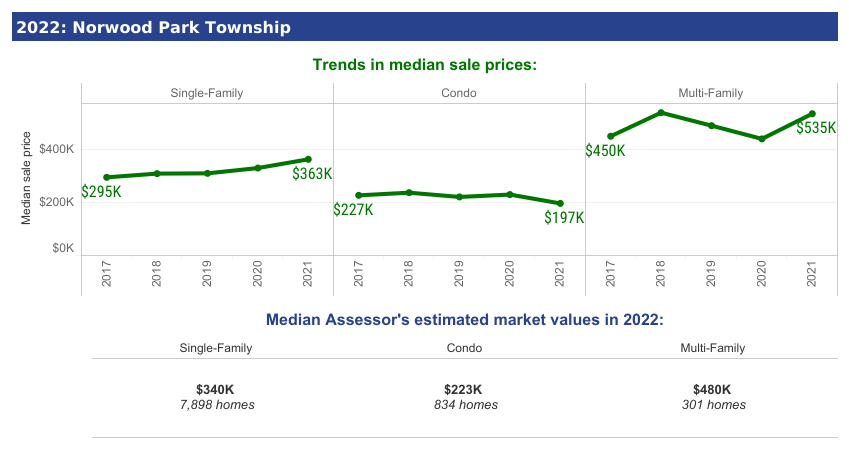

Massachusetts Property Tax Rates. Town Residential Tax Mill Rate Commercial Tax Mill Rate. The revaluation will be completed by August 2022.

Tax rates are expressed in mills with one mill equal to 1 of tax for every 1000 in assessed property value. Tax rates in Massachusetts are determined by cities and towns. No new states had property qualifications although three had adopted tax-paying qualifications Ohio Louisiana and Mississippi of which only in Louisiana were these significant and long lasting.

Rental price 70 per night. 2021-48 and for what tax year 2020 or 2021 as applicable. To request information regarding entering a NEW Installment Agreement please call 607-778-6431 and leave your name the town the property is in tax map number property address and your daytime phone number.

Texas has a state constitutional prohibition against a state property tax and sales taxes. 2021 Annual Financial Audit Report. The State of Maine has set up a Tree Growth category of property which values land according to rates established by the State rather than market value.

State corporate tax rates 2021 State Brackets Ala. Final Assessment Rolls 2022. The Valuation Date is April 1 2021.

All real property tax exemptions are administered at the local level. Arizona ˌ ær ɪ ˈ z oʊ n ə ARR-ih-ZOH-nə. The Town of Falmouth commenced its revaluation of all real estate beginning in January 2021.

369 2010 The Roxbury Town Office is currently closed. The Panama Canal Zone was essentially a company town but the others all began levying income taxes under American rule. Town of Fenton.

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. The median property tax in Connecticut is 163 of a propertys assesed fair market value as property tax per year. Anywhere outside Miami-Dade county has a transfer tax of 07 of the sale price.

Town of Kennebunkport PO Box 566 6 Elm Street Kennebunkport ME 04046 PH. Website Disclaimer Government Websites by CivicPlus Site Map.

Cost Of Living In Maine The True Cost To Live Here Upnest

Property Tax Information Town Of Bowdoin Maine

Your Guide To 2021 Closing Costs In Maine Newhomesource

Connecticut Ct Property Taxes H R Block

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Revaluation Project 2021 2022 Falmouth Me

Property Taxes By State Quicken Loans

Property Reassessments Begin In Cook County S North Suburbs Cook County Assessor S Office

Tax Rates Town Of Kennebunkport Me

Residential Taxpayers Have Taken On More Of City S Tax Burden Assessor Says

Vermont Property Tax Calculator Smartasset

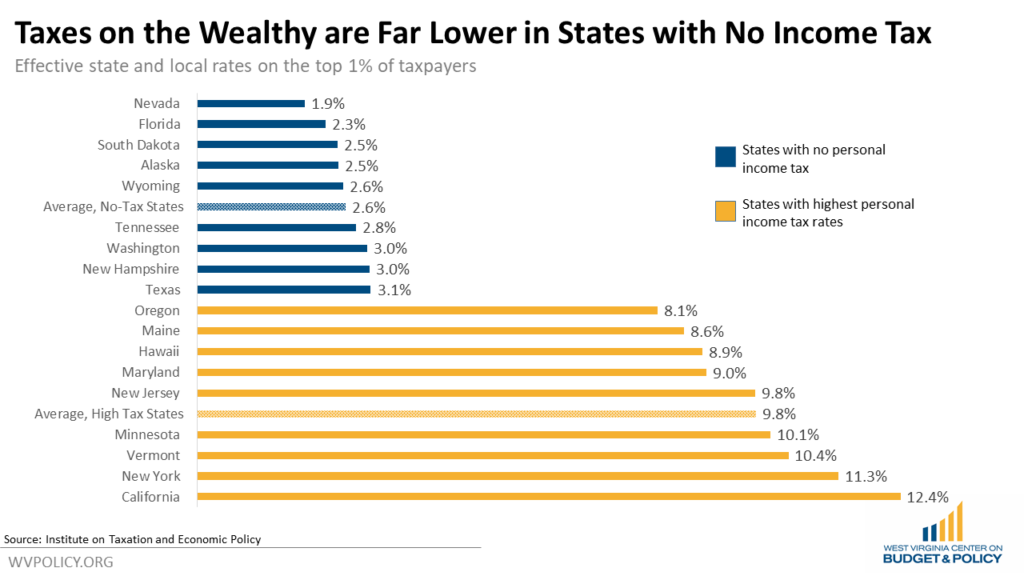

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

New Property Tax Law Ld 290 Effective August 8 Default

The Most And Least Tax Friendly Us States

Property Taxes Could Soar 30 To 50 Business Jhnewsandguide Com